VIEWS: 1328

July 29, 2024‘Pathway to Home Ownership’ Program Helps Members Become Mortgage Ready

On June 25, the Salt River Pima-Maricopa Indian Community’s Pathway to Home Ownership program held a meeting for all SRPMIC members with the goal of outlining the process of becoming a homeowner.

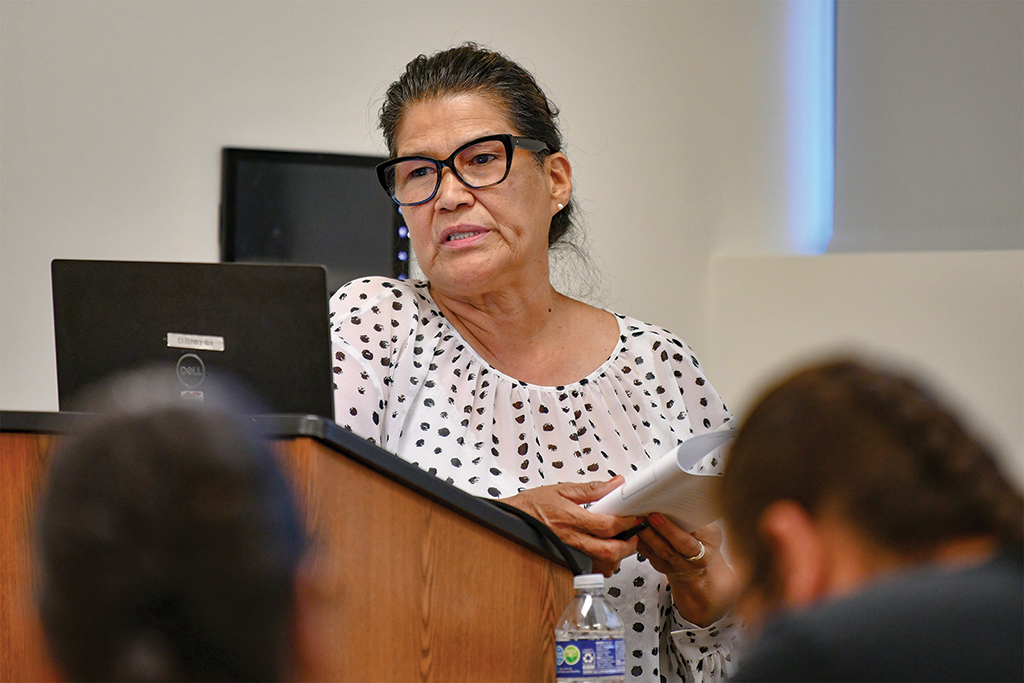

The meeting was held in Two Waters’ A building in room 107. Lori Calderon, community outreach supervisor from the SRPMIC Health and Human Services Department, and Gracie Briones, financial training coordinator, served as presenters for the meeting.

“I was looking at some information and I saw that people are paying $2,000 a month for rent. If you multiply that by 12 months, that’s a considerable amount of money for a place that’s temporary,” said Calderon.

Detailing the difference between renting and purchasing a home, Calderon emphasized that owning a “forever home” provides stability for families, in addition to many more positives. “Once you become a homeowner, the home becomes your forever home. There is pride in ownership, and it helps create strong community ties,” she said.

“We’re getting more and more homes built, and the tribe is looking at investing in other different housing opportunities. In Indian Country, there always seems to be a housing crisis. But it is getting better,” Calderon added.

Briones explained that becoming a homeowner is a process. “I work on the front-end part of the process of home ownership,” began Briones. “I do your financial assessment. We will assess your situation, and if there’s work to be done, we’ll help you create an action plan.

Having reliable income, having steady work, maintaining checking/savings accounts and filing tax returns are some of the requirements for obtaining a mortgage. Knowing how to manage finances is crucial to becoming mortgage ready. “If home ownership was easy, everyone would have a house,” said Briones.

Continuing her presentation, Briones brought up land ownership. “That is a separate part of the [mortgage] process. If you have land, but it hasn’t been recorded in your name, that takes time to get completed. You can be working on that while working on the financial side as well.”

Briones provided suggestions for managing finances and keeping a budget. “Sometimes people will have spreadsheets for their budget. I can’t do that personally. It’s about what works for you,” she said. “Print the last two months of your bank statements and highlight every time you swiped your debit card. Then total it up at the end of the month. Was it a necessity or wasteful spending?”

Additionally, Briones informed the group that the SRPMIC does count per capita as part of a Community member’s financial portfolio. “We previously did not accept per capita as qualifying income, but now we do,” she said.

Community members who are interested in learning more about the home ownership process may contact Lori Calderon at (480) 362-5763 or Gracie Briones at (480) 362-7833.