VIEWS: 1504

October 6, 2022SRFSI and Native-Owned Business Present Insurance Workshop for Community

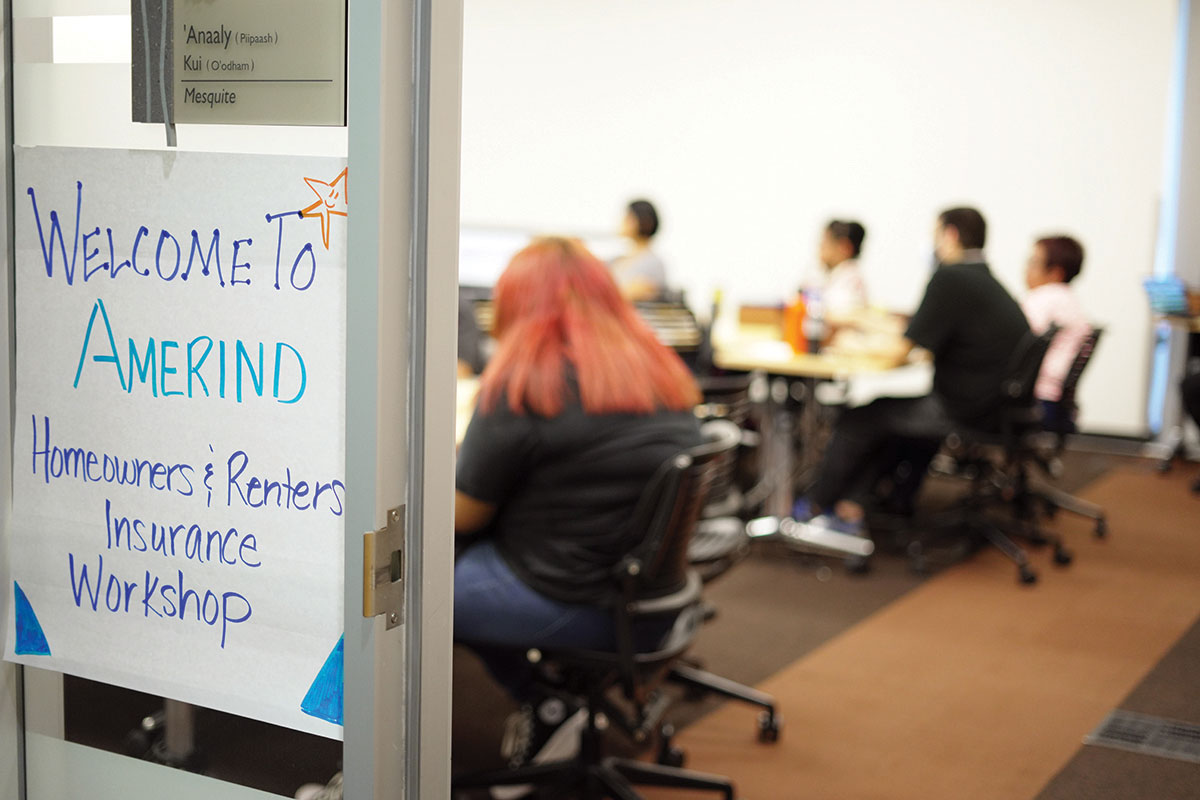

The Salt River Financial Services Institution (SRFSI) hosted a workshop on homeowner’s insurance and renter’s insurance for members of the Salt River Pima-Maricopa Indian Community on Tuesday, September 13. The workshop was held once in the afternoon and once in the evening at Two Waters Building B. Leah Cristobal, customer experience manager with Amerind, presented the workshop.

Gracie Briones, financial education training coordinator, said she thought it was a good time for the topic because of the damage caused to Community homes from monsoon storms in July.

“We just want help people protect their homes and personal belongings; some could be very valuable, especially when they’re passed down from family members,” Briones said.

She added that homeowner’s insurance is important because for most people, their home is their No. 1 asset, and that asset needs insurance protection. “A lot of Community members have owned their homes for years, but after they paid them off, they never renewed their homeowner’s insurance. It’s really important to be covered.”

Amerind is a 100% Native-owned insurance company focused on serving the tribal marketplace, which it believes is underserved by the large commercial insurance companies. It offers flexible and affordable coverage for homeowners and renters on tribal land through its Native American Homeowners and Renters (NAHR) insurance program.

“We don’t do credit checks, so your whole premium is based solely on what [coverages] you need. Other companies do a credit check and increase or decrease your premium based on things such as … whether you have a fire department within so many miles of your home. If your home doesn’t meet that requirement, [that insurance company may] increase their premium or they won’t offer you insurance. At Amerind, we don’t have any fire department restrictions because we understand that a lot of Indian Country [homes are] in rural areas,” said Cristobal.

The NAHR plan allows the homeowner to select the coverages and coverage limits based on their needs.

Amerind’s coverage options are:

• Dwelling coverage—The limit of your dwelling is the cost to replace like and kind. Amerind will calculate how much your home is worth, how much it will cost to rebuild, and calculate your dwelling limit at replacement cost.

• Personal Belonging coverage—Covers items like furniture, clothing, computers, televisions, etc.

• Other Structures coverage—Covers detached garages, tool sheds, barns and carports. “A detached structure is not attached to the house, so we would give you up to 10% at no charge for any detached structure,” said Cristobal.

• Personal Liability—This is third-party liability for bodily injury and property damage. For example, if a person is in your home as a guest or is on your property and is injured, this will cover their medical expenses.

• Scheduled Property—This covers items with intrinsic value, such as jewelry, artwork, pottery and ceremonial regalia.

• Loss of Use—This covers the additional cost of living expenses (hotel, food, etc.) due to a covered property loss.

• Builder’s Risk—This helps cover a home undergoing construction or renovation.

Amerind does not offer flood insurance. To obtain flood insurance, you have to apply to the National Flood Insurance Program; go online to www.fema.gov/flood-insurance for the information.

To qualify for Amerind’s NAHR insurance program, you must be an enrolled member of a federally recognized tribe and your home must be located on a reservation, on restricted land, on trust land or on an Indian allotment. Amerind does not provide insurance to those living off the reservation. You need to fill out the application form and provide four color exterior photos of your home along with a copy of your tribal ID.

What’s it going to cost? “It’s hard to say, because my house is different from your house, and her house could be different from both of the other two houses,” said Cristobal at the workshop. “Location also is a big factor—for example, Arizona is not like Oklahoma. Arizona doesn’t have tornadoes. Our average homeowner’s insurance premium in this area is anywhere from $600 to $800 a year.” Amerind offers several payment plans.

For more information about Amerind’s insurance program, go online to https://amerind.com/services/homeowners-renters/ or contact SRFSI at (480) 362-7600.